BY MARK BLESSINGTON – True or false: Are America’s wealthy few growing their wealth at the expense of everyone else? The question is not whether the rich are getting richer. The question is whether they are gaining wealth at the expense of everyone else.

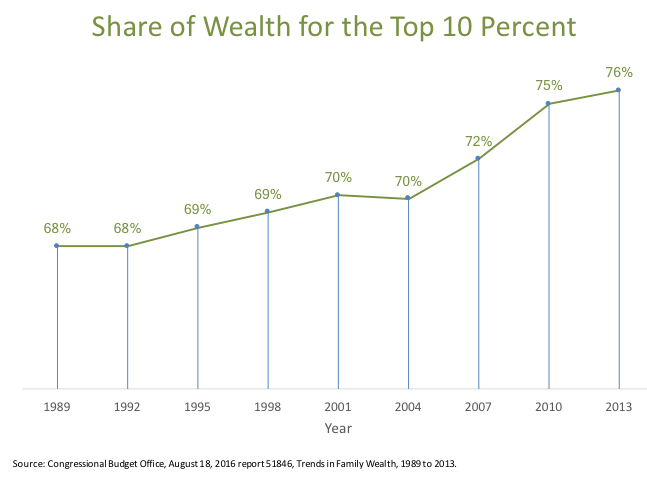

The Congressional Budget Office provides a comprehensive report on wealth every three years. The percent of total wealth owned by the top 10 percent of all families is shown below.

The unavoidable and indisputable conclusion: The top 10 percent is getting wealthier at the expense of everyone else.

Why did wealth grow faster for the top 10 percent over the last quarter century? Most of the answer involves income. The math is simple:

more income ![]() more investing

more investing ![]() more wealth.

more wealth.

In other words, wealth for the top 10 percent grew faster because their income grew faster.

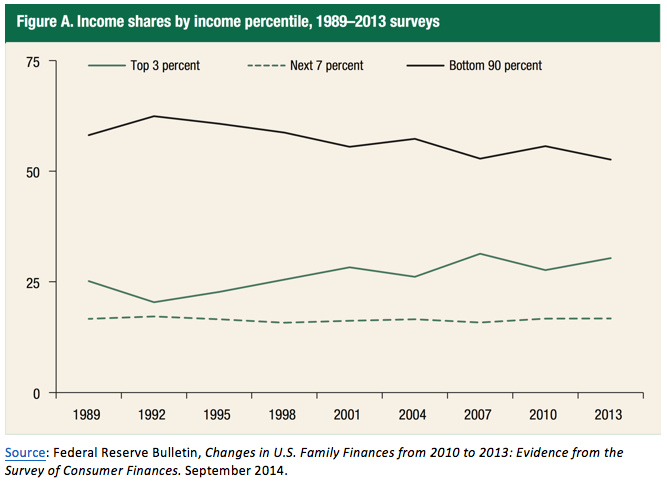

Analyses from the Federal Reserve clearly indicate that the income share for the top 10 percent grew at the expense of everyone else. The Fed goes even further. They show that the top 3 percent is the only group that took a greater share of income over the last quarter century. The next 7 percent was level, and the bottom 90 percent declined.

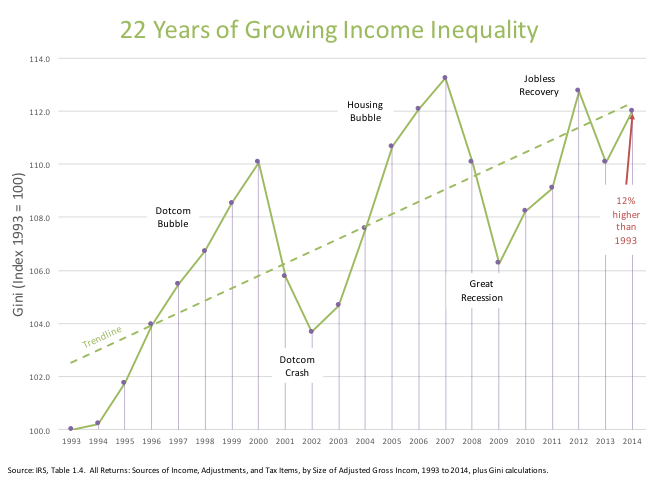

Another way to track income inequality is the Gini statistic. Gini rises with the level of inequality. Starting with a baseline of 100 in 1993, income inequality rose in the US despite a series of severe business cycles. It could be argued that the wealthy few played a major role in creating the dotcom craze and the great recession. But rather than suffer defeats, they ultimately came out ahead.

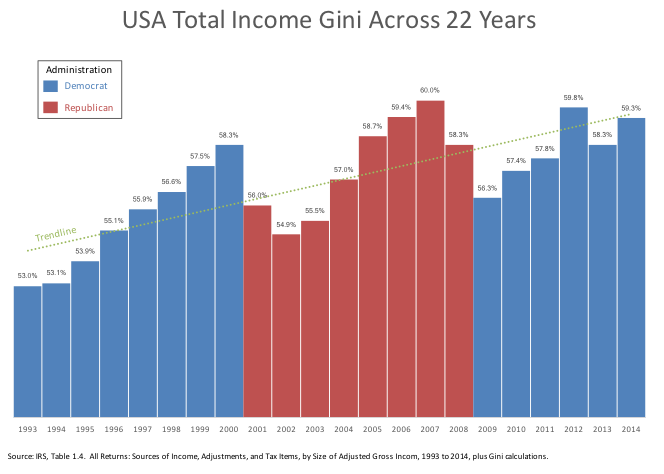

It is important to examine Gini levels across various political administrations. The inescapable conclusion is that Gini has grown regardless of who is President or whether we have a Republican or Democratic administration. Both parties have catered to the wealthy few. Their power permeates both political parties.

No Level Playing Field

What does it mean when one group benefits at the expense of others? Classic economic theory would hold that the top 10 percent gained because they added more value relative to everyone else. The wealthy few sometimes rationalize their outsized gains by arguing that they are smarter than the rest of us. During the recent presidential campaign, Donald Trump personified these claims. He made it clear he views himself as smarter than everyone else, that he knows more about taxes, that he knows more than the generals, and so on.

But there is at least one major problem with the assertion that the top 10 percent deserved their outsized gains: there is no level playing field. The rules favor the wealthy few. They have far more advantages in our economy over everyone else, especially in the political and legal realms. They fund PACs, lobbyist and lawyers to push their interests at the expense of everyone else.

Proof that there is a biased playing field is provided in a study by Martin Gilens and Benjamin Page. They conclude that the wealthy few and special interest groups for business have substantial impacts on U.S. government policy, while average citizens and groups supporting them have little to no influence.[i] In short, we have an oligarchy in the USA.

Capitalism has no argument with top producers earning more. Capitalism becomes something else when the wealthy few benefit at the expense of everyone else, and for no reason other than they have the power and the means to take more than their fair share. That’s not capitalism; that’s oligarchy.

While American productivity rose, income for American workers stagnated. For decades, as Americans worked harder and smarter, the fruits of American productivity gains were claimed exclusively by the top 10 percent. Again, this is not capitalism, it is a systematic pattern of “reverse robin hood.”

Blowing Smoke

Our government is charged with the responsibility of maintaining a healthy economy. Just as societies do not self-regulate, neither do economies. Civil society requires laws and a system of justice. The same is true of economies: laws provide the foundation for an economy. Then those laws need to be enforced by government and our legal system. This creates trust. Economies flourish with trust, and eventually decline without it.

Political conservatives claim we have too many laws, which hampers economic growth. This is propaganda; a simple-minded bastardization of classic economic theory. In fact, classic economic theory has always called for regulations that maintain a level playing field.[ii]

America’s government has failed to provide a level playing field. The interest of the wealthy few have driven political and legal decision making to favor them at the expense of everyone else. The facts prove it, and this has been going on for decades in the USA.

Progressive Taxes

The short-term solution is to raise taxes on the wealthy few. The current conservative proposal is to cut income taxes at the top. They claim the benefits will trickle down to everyone else. The absolute fraud of the trickledown claim is laid bare by the facts. We’ve had trickledown economics for decades, and it only benefits the wealthy few.

Tax cuts for middle America are immediately spent in the economy or used to pay off debt. Tax cuts for the wealthy few, on the other hand, mostly go toward investments, which does not feed the economy.[iii] It is far more credible to expect that diverting money from middle America to investments by the wealthy few reduces consumption and depresses rather than fuels the economy.

How Much Money Are We Talking About?

The top 10 percent of wealthy Americans owned 76 percent of total US wealth in 2013. That year, aggregate family wealth was $67 trillion.[iv] So, the top 10 percent held about $51 trillion in 2013.

How much is $51 trillion?

- The number 51 followed by 12 (yes, twelve!) zeros.

- More than 3 times the USA’s gross domestic product in 2013.[v]

- 32% of total world wealth.[vi]

- More than the combined wealth of China, Japan, United Kingdom and Germany.[vii]

There is no ethical way to justify such an egregious concentration of wealth among so few. It is a gross distortion of capitalism, and it impacts the entire world. Progressive taxes would help fix the imbalance created by an uneven playing field for the last quarter century. For example:

- A 1% wealth tax on the upper half of the top 10 percent’s wealth would generate $255 billion a year.[viii]

- A 100% tax on all annual income over $10 million would generate another $255 billion a year. [ix]

How much is $255 billion?

- It equals all of Trump’s proposed budget cuts ($58.6 billion) and increases ($60.4 billion), plus and additional $136 million for Affordable Healthcare rate discounts, college tuition relief, and so on.

- It equals the taxes paid by everyone in 2016 who earned less than $75,000 plus $66 billion for further tax relief.

Pushback

The above two tax programs together would generate over half a trillion dollars a year. As we can imagine, the pushback will be immense. The wealthy few have trillions at stake, and they will spend many billions if not trillions to keep what they have. They will wage all-out war. They will deploy their massive power to fight. They have unfair advantages across our economic, political, and legal systems, and they will leverage them aggressively to quash any redistributive taxation.

The simple fact, however, is that the wealthy few only have as much power as we give them.

Americans tend to be easily intimidated by wealth. We have let ourselves be bullied by the wealthy few for centuries. But from time to time we also stand up and say: That’s Enough! You’ve gone too far!

After the Great Depression Americans assumed a bold persona embodied in Franklin Delano Roosevelt. With a supermajority of Americans behind him, he reversed income and wealth inequality. He implemented progressive taxes and stood up to powerful corporate interests. He restored a level playing field, and the bulk of Americans won. They took back what was rightfully theirs. They restored their fair share of the American dream.

Restore True Capitalism

There is no way to be polite about egregious misappropriation of income and wealth. On the one hand, it is perpetrated by ugly, rampant greed. On the other, it is enabled by widespread cowardice.

Progressive taxes are the most immediate and effective tool for moving toward economic balance. It does not fix the problem at its core, but it takes a big step forward.

Fair distribution of income and wealth must become an integral part of the American political lexicon. We need to talk about how much money is taken from Americans every year by the wealthy few. We need to quantify the benefits of progressive taxation We need to become more facile with detecting economic propaganda. We need to hold conservative economists accountable for their economic lies and deceit.

The wealthy few are not going to help us rebalance the economy. It is up to us – the remaining 90 percent. We must restore capitalism, put an end to oligarchy, and create a level playing field on which capitalism can flourish for everyone once again.

* * *

Mark Blessington has an insider’s view of Corporate America. After receiving an MBA from Northwestern University in marketing, he pursued a 30-year career as a consultant to some of the world’s largest corporations. For the last 15 years and with Howard Zinn as his inspiration, he has published numerous articles that reexamine various political economics topics from the perspective of common citizens.

* * *

[i] Martin Gilens and Benjamin I. Page, Testing Theories of American Politics: Elites, Interest Groups, and Average Citizens, American Political Science Association, September, 2014.

[ii] For example, Adam Smith called for strict government regulation of the banking industry. Wealth of Nations, 1776, Book 5, Chapter 1, Part 3, Article 1. Later, F. A. Hayek called for better laws to ensure fair competition in The Road to Serfdom, 1944, Chapter 3.

[iii] The major source of corporate funding over the last quarter century has been through debt, not equity financing.

[iv] Congressional Budget Office, Trends in Family Wealth, 1989 to 2013, August 2016, page 1.

[v] World Bank: http://data.worldbank.org/country/united-states

[vi] Alianz, Global Wealth Report, 2016. Top 10% wealth share of 76% x USA share of world wealth of 42% in 2016 = 32%.

[vii] Alianz, Global Wealth Report, 2016. After the USA, the next four countries’ share of world wealth (Japan, China, United Kingdom, and Germany) is 31%.

[viii] $51 trillion held by the top 10% x 50% of the top half’s wealth x 1% wealth tax = $255 billion

[ix] The IRS provides income and tax details in its annual reports. In 2016, the group with adjusted gross incomes (AGIs) over $10 million had an average income of $30.4 million and an effective tax rate of 25.4% for 16,733 tax returns. The new total tax for this group would be $384 billion versus the old $129 billion, yielding a gain of $255 billion.